Employment, Education and Agriculture to be the Focus Areas in Medium Term, Says Survey

New Delhi: The Economic Survey 2017-18 predicts to growth in 2018-19 and confident that real GDP growth will rise to 7.0 to 7.5 percent in 2018-19. In the Economic Survey 2017-18 tabled in Parliament today by the Union Minister for Finance and Corporate Affairs, Arun Jaitley, said the reform measures undertaken in 2017-18 can be strengthened further in 2018-19.

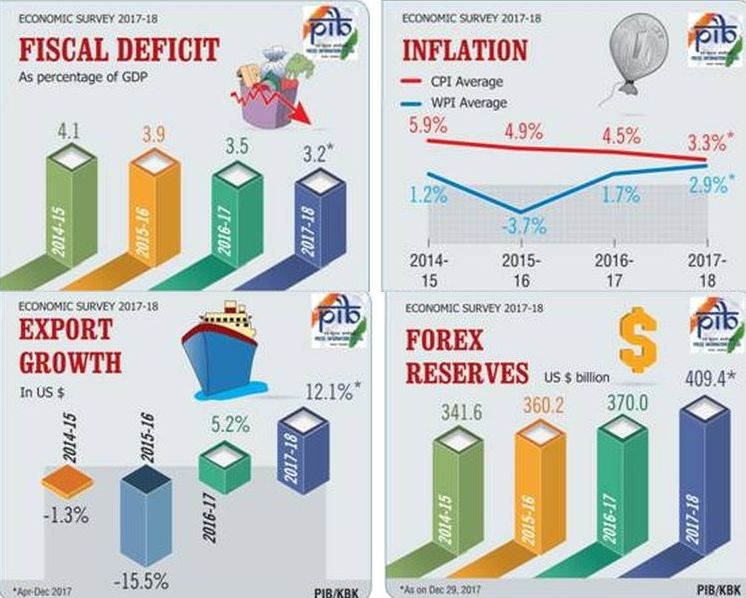

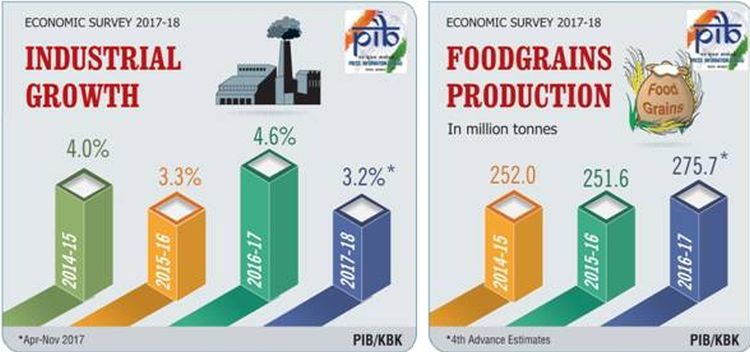

The survey underlines that due to the launch of transformational Goods and Services Tax (GST) reform on July 1, 2017, resolution of the long-festering Twin Balance Sheet (TBS) problem by sending the major stressed companies for resolution under the new Indian Bankruptcy Code, implementing a major recapitalization package to strengthen the public sector banks, further liberalization of FDI and the export uplift from the global recovery, the economy began to accelerate in the second half of the year and can clock 6.75 percent growth this year. The survey points out that as per the quarterly estimates; there was a reversal of the declining trend of GDP growth in the second quarter of 2017-18, led by the industry sector. The Gross Value Added (GVA) at constant basic prices is expected to grow at the rate of 6.1 per cent in 2017-18 as compared to 6.6 per cent in 2016-17. Similarly, Agriculture, industry and services sectors are expected to grow at the rate of 2.1 per cent, 4.4 per cent, and 8.3 per cent respectively in 2017-18. The survey adds that after remaining in negative territory for a couple of years, growth of exports rebounded into positive one during 2016-17 and expected to grow faster in 2017-18. However, due to higher expected increase in imports, net exports of goods and services are slated to decline in 2017-18. Similarly, despite the robust economic growth, the savings and investment as a ratio of GDP generally declined. The major reduction in investment rate occurred in 2013-14, although it declined in 2015-16 too. Within this the share of household sector declined, while that of private corporate sector increased.

The survey points out that India can be rated as among the best performing economies in the world as the average growth during last three years is around 4 percentage points higher than global growth and nearly 3 percentage points higher than that of Emerging Market and Developing Economies. It points out that the GDP growth has averaged 7.3 per cent for the period from 2014-15 to 2017-18, which is the highest among the major economies of the world. That this growth has been achieved in a milieu of lower inflation, improved current account balance and notable reduction in the fiscal deficit to GDP ratio makes it all the more creditable.

Though concerns have been expressed about growing protectionist tendencies in some countries but it remains to be seen as to how the situation unfolds. Some of the factors could have dampening effect on GDP growth in the coming year viz. the possibility of an increase in crude oil prices in the international market. However, with world growth likely to witness moderate improvement in 2018, expectation of greater stability in GST, likely recovery in investment levels, and ongoing structural reforms, among others, should be supporting higher growth. On balance, country’s economic performance should witness an improvement in 2018-19.

The survey highlights that against the emerging macroeconomic concerns, policy vigilance will be necessary in the coming year, especially if high international oil prices persist or elevated stock prices correct sharply, provoking a “sudden stall” in capital flows. The agenda for the next year consequently remains full: stabilizing the GST, completing the TBS actions, privatizing Air India, and staving off threats to macro-economic stability. The TBS actions, noteworthy for cracking the long-standing “exit” problem, need complementary reforms to shrink unviable banks and allow greater private sector participation. The GST Council offers a model “technology” of cooperative federalism to apply to many other policy reforms. Over the medium term, three areas of policy focus stand out: Employment: finding good jobs for the young and burgeoning workforce, especially for women. Education: creating an educated and healthy labor force. Agriculture: raising farm productivity while strengthening agricultural resilience. Above all, India must continue improving the climate for rapid economic growth on the strength of the only two truly sustainable engines—private investment and exports.

GST data reveals 50% increase in number of Indirect Taxpayers

A preliminary analysis of the Goods and Services Tax (GST) data reveals that there has been a 50% increase in the number of indirect taxpayers, besides a large increase in voluntary registrations, especially by small enterprises that buy from large enterprises and want to avail themselves of Input Tax Credits (ITC). The Economic Survey 2017-18 reveals that there were 9.8 million unique GST registrants slightly more than the total Indirect Tax registrants under the old system (where many taxpayers were registered under several taxes). Therefore, adjusting the base for double and triple counting, the GST has increased the number of unique indirect taxpayers by more than 50 percent –a substantial 3.4 million. The profile of new filers is interesting of their total turnover, business-to-consumer (B2C) transactions account for only 17 percent of the total.

The bulk of transactions are business-to-business (B2B) and exports, which account for 30-34 percent apiece. There are about 1.7 million registrants who were below the threshold limit (and hence not obliged to register) who nevertheless chose to do so. Indeed, out of the total estimated 71 million non-agriculture enterprises, it is estimated that around 13 percent are registered under the GST. Maharashtra, UP, Tamil Nadu and Gujarat are the States with the greatest number of GST registrants. UP and West Bengal have been large increases in the number of tax registrants compared to the old tax regime. It also underlines that the distribution of the GST base among the States is closely linked to the size of their economies, allaying fears of major producing States that the shift to the new system would undermine their tax collections.